Navigating the landscape of BNPL providers for e-commerce merchants

In today's competitive B2B commerce landscape, offering flexible payment solutions is no longer just an option—it's a necessity. As Buy Now, Pay Later (BNPL) options continue to rise in popularity, selecting the right provider becomes a pivotal decision for merchants. But with so many options available, how do you make the right choice?

Understanding your business needs

The first step in selecting a BNPL provider is understanding the unique needs of your business. This involves a thorough assessment of your customer base, average transaction values, and the typical sales cycle. Such insights will help in identifying a BNPL solution that aligns perfectly with both your operational needs and your clients' expectations.

The importance of security and reliability in BNPL solutions

Security and reliability cannot be overstated when it comes to financial transactions. A BNPL provider should not only ensure the safety of sensitive information but also boast a robust infrastructure capable of handling high transaction volumes without hitches. Exploring the provider's track record and seeking feedback from current users can offer valuable insights into their reliability.

Integration ease - A key consideration for seamless operations

Integration ease is another critical factor. The chosen BNPL solution should seamlessly integrate with your existing platforms, ensuring a smooth workflow. This minimizes disruptions and allows for a more efficient operation, enhancing the overall customer experience.

Start by evaluating the technical parameters, and how easy your chosen BNPL solution can be added to your current checkout process.

Make sure that it is compatible with your e-commerce platform and/or PSP, and that there is support for available plugins. While plugins offer rapid integration, they might not support the full spectrum of features that a BNPL provider offers. Essential features like country availability, desired payment methods, and risk prevention tools is very important to verify.

Evaluating the cost - Understanding the financial implications

Cost is invariably a consideration in any business decision. It's important to weigh the cost of implementing and maintaining a BNPL service against the potential revenue growth it could drive. Transparent pricing models and a clear understanding of any associated fees are crucial to avoid any unwelcome surprises down the line.

Typically, BNPL providers impose a percentage of the transaction value, coupled with a fixed processing fee. However, pricing structures differ among BNPL providers. For instance, some may not charge variable fees on returned orders, while others may do so. Always compare various payment methods comprehensively, because one might appear cheaper initially than it really is. Return costs can also vary a lot or there can be potential hidden costs, such as chargebacks or gateway fees from their PSP. Have a look for details of the pricing structure and be aware of all costs for consumers and merchants to make sure you can carry the cost of any fees.

Risk Management and Fraud Prevention

BNPL methods introduce also risks, which could be passed on to merchants. Often, these aspects are not actively discussed during the sales process. Instead, they can be hidden in long contracts, and result in unexpected financial challenges for the merchant. Be sure to raise this topic in your sales discussions. Take a closer look at the fraud and shipping policy and investigate if there are fraud prevention tools such as Strong Customer Authenitcation (SCA) available.

Try to find a BNPL provider who takes responsibility for both identifying and covering potential fraud risks and aims for an optimal acceptance rate.

The role of customer support in ensuring BNPL success

Lastly, customer support is the backbone of any service-oriented solution. A provider that offers comprehensive support, including training for your staff and assistance for your customers, can significantly ease the transition to a BNPL model and ensure its long-term success.

To prevent possible frustrations, inform yourself about the chosen BNPL providers account management setup and local merchant support. This can significantly reduce waiting times and improve the merchant experience.

Making an informed BNPL provider choice for future growth

In conclusion, as e-commerce merchants strive to meet the evolving needs of their clients, the choice of a BNPL provider becomes increasingly critical. By focusing on the specific needs of their business, security, integration ease, cost, and customer support, merchants can make an informed decision that not only meets their immediate needs but also positions them for future growth. In a world where flexibility and convenience are paramount, the right BNPL solution can be a game-changer for e-commerce merchants looking to elevate their service offering and strengthen their market position.

Discover our payment methods

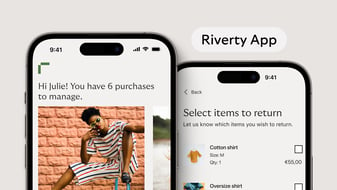

The complete Buy Now Pay Later ecosystem for ecommerce which keeps your brand in the lead while offering a competitive array of services to build loyal customers.