Understanding overdrafts and their fees

At Riverty, we believe in equipping you with the knowledge and tools to navigate your financial journey with confidence. Today, let's delve into the world of overdrafts – a concept that may sound familiar to you. An overdraft can be seen as a kind of safety net provided by your bank. And allow account holders to withdraw more money than they have available in their checking accounts. This can be a lifesaver in emergencies or when unexpected expenses arise. It allows you to make transactions even when your account balance is insufficient, providing temporary relief during unexpected expenses or cash flow gaps.

The price tag of overdrafts

Sounds quite nice, right? Well, let's not get too excited, because it is important to understand that these overdrafts come with a price tag. Called overdraft fees. These fees, imposed by banks when your account is overdrawn, can add up quickly, especially if multiple transactions trigger overdrafts within a short period. They can have a significant impact on your finances and make it harder to break free from the burden of debt.

Overdrafts in the United States

In the United States, overdraft fees have long been a contentious issue, as well as a recurring theme in a movie. These fees disproportionately impact vulnerable populations as noticed by consumer advocacy groups and policymakers. Here, consumers are charged a fee per transaction carried out while their account is overdrawn. For instance, minor purchases like a Coke at McDonald’s can result in significant fees.

Many consumers are either unaware of these charges or underestimate their impact when their account is overdrawn. Despite efforts by the Consumer Financial Protection Bureau (CFPB) to address these concerns, overdraft fees remain a significant revenue source for banks. This cycle of overdrafts and fees traps individuals in financial insecurity, hindering their ability to build savings or access credit. Recent studies show that overdraft fees generate billions of dollars in revenue for banks each year, primarily at the expense of low-income individuals and those living pay-check to pay-check. For many people, these fees result in financial instability, making it harder to break free from the burden of debt.

Overdrafts under the European lens

In the European Union, overdrafts carry less weight compared to the US, but concerns persist regarding their impact on consumer financial well-being. Without a clear path to financial stability, individuals may continue to struggle with overdrafts. The EU does however has taken steps through directives aimed at enhancing consumer protection and promoting financial inclusion.

Addressing the debt resulting from overdrafts requires a comprehensive approach, including regulatory oversight, financial education, and support services. Measures such as fee caps and mandatory disclosures have been put in place to mitigate the risks associated with overdrafts and ensure consumers are fully informed about costs. Additionally, initiatives promoting responsible lending and debt management are vital in addressing the root causes of overdraft-related debt and fostering financial resilience among EU citizens. However, here as well there is no clear path to financial stability without changes in financial habits.

BNPL

In the light of the challenges posed by overdraft fees, consumers are exploring BNPL services, allowing them to make purchases and pay in instalments over time, often with zero interest. This flexibility appeals to many, particularly millennials and Gen Z, who prefer spreading costs rather than paying upfront. While this flexibility appeals to many, it's essential to highlight the negative points as well.

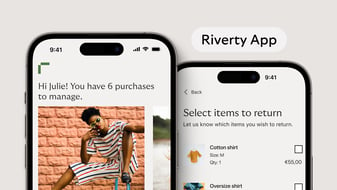

Late payment fees do exist with BNPL options, and it's crucial to pay off the balance within the specified period to avoid additional charges and fees. At least there is a built-in path to financial stability with BNPL, as the short repayment period and reminders from the app or even traditional dunning letters will help you to pay on time. When comparing overdrafts and BNPL, always consider your financial situation carefully.

Getting control on fees

Here's the uplifting part - you can take control. Consider these insights to help you manage overdrafts:

- Keep a close eye on your account balance to avoid overdrafts.

- Set up alerts or notifications to stay informed about your account status.

- Consider opting out of overdraft protection if you prefer not to incur fees.

- Communicate with your bank to explore alternative solutions or negotiate fees.

Whether it's managing overdrafts, avoiding overdraft fees, or exploring BNPL options, being informed and having control is key to make financial decisions. By weighing the pros and cons of each option and adopting responsible financial habits, you can steer your finances toward a brighter future.