Your accounting on auto-pilot

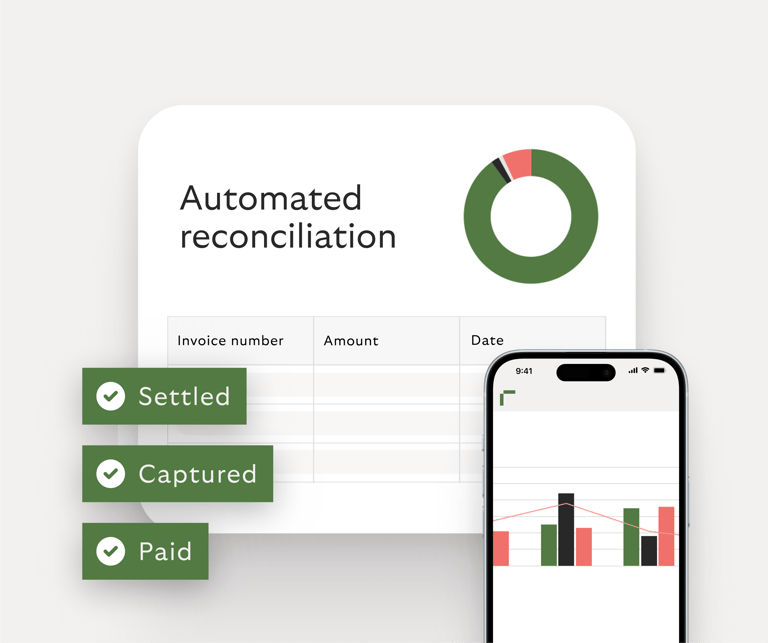

Accounting as a Service (AaaS) automates 99% of reconciliation and A/R Management from start to audit, while experts take care of the remaining 1%.

![]() In-house accounting experts

In-house accounting experts

![]() Fast track to S/4HANA migration

Fast track to S/4HANA migration

![]() International scaling

International scaling

![]() High transaction volumes

High transaction volumes

Scale, grow and streamline your accounting

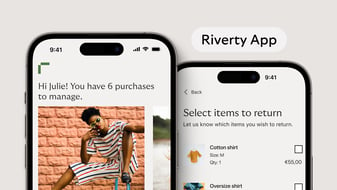

Riverty empowers fast-growing businesses to manage complex accounting tasks with full-service A/R management, exception handling, reconciliation, and legal debt collection.

Simplify your S/4HANA migration with Riverty. From planning to operation - fully automated Accounting-as-a-Service that cuts effort and costs. Focus on progress. We handle the accounting.

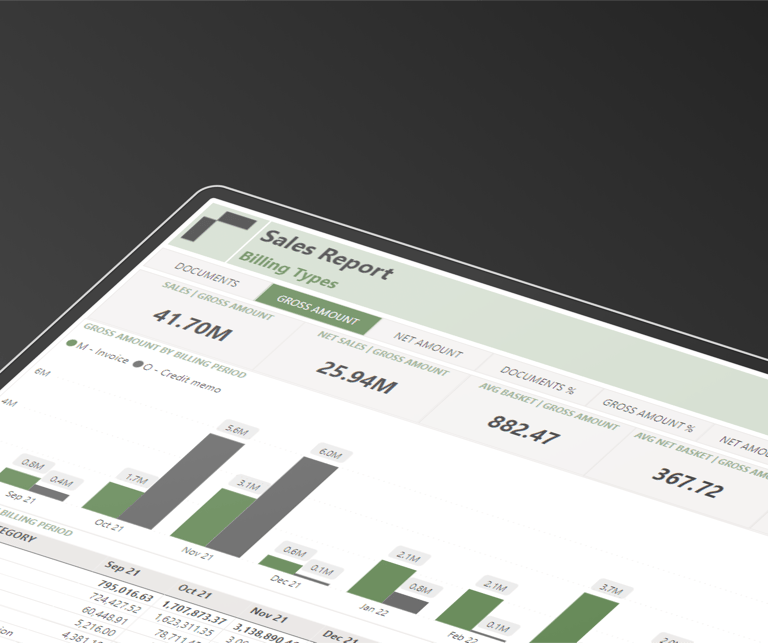

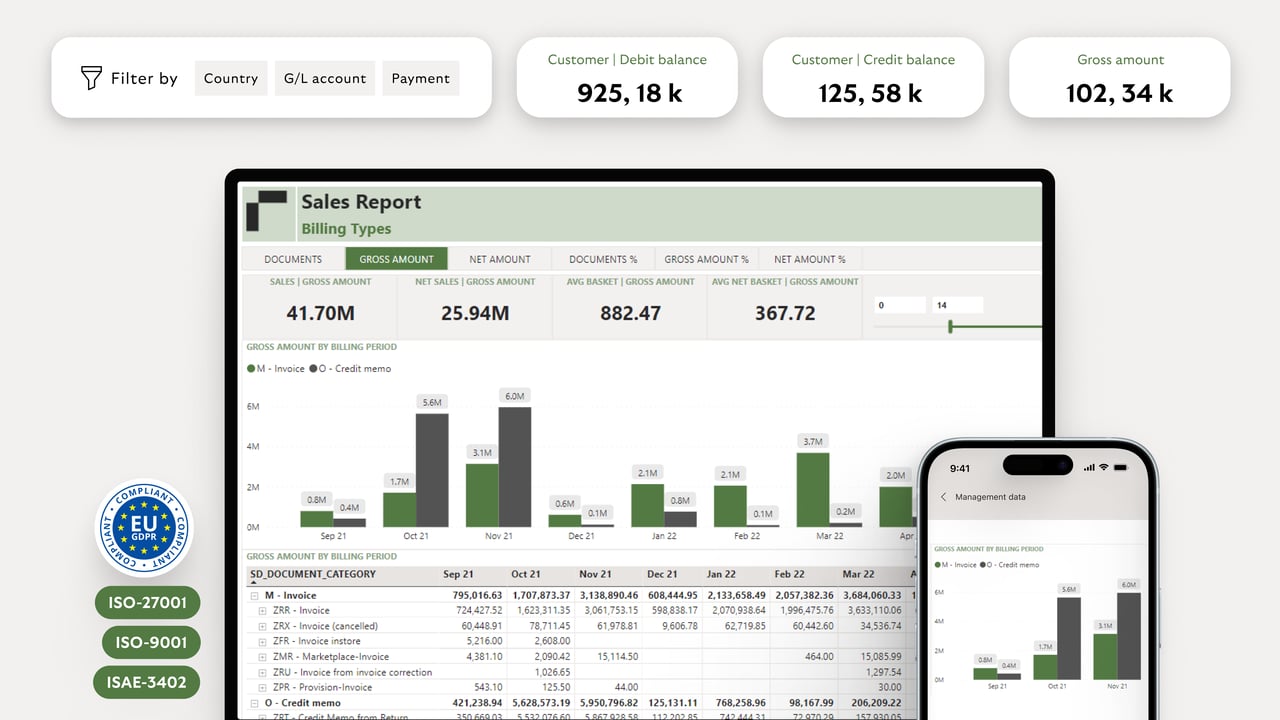

We process 100m+ order-to-cash transactions per year and reconcile 35+ payment methods worldwide.

Automation without compromise.

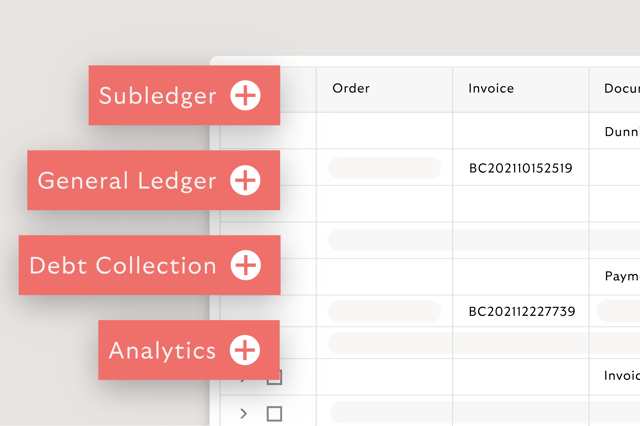

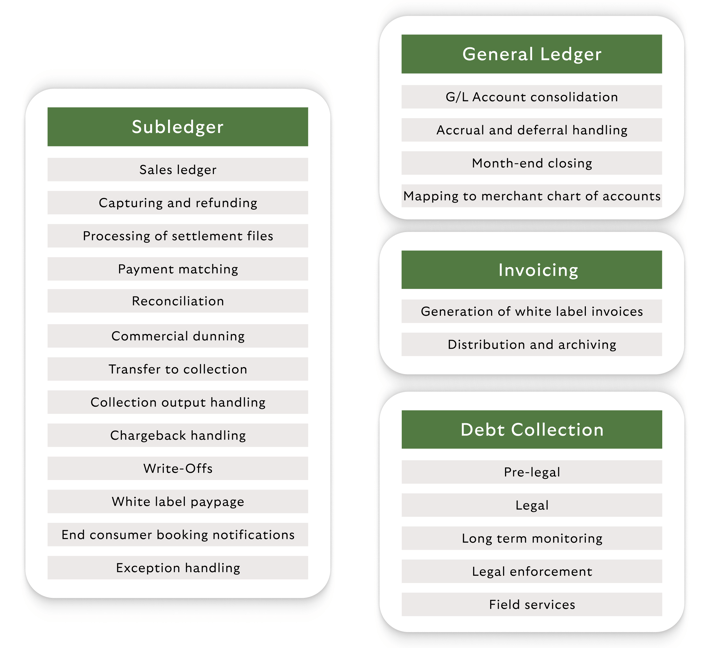

Our solution provides you with a fully compliant end-to-end service including reconciliation and accounts receivable management, integrating seamlessly with your third-party providers such as PSPs, banks, or your ERP/general ledger.

Save up to 30% on your accounting costs

By automating routine tasks and reducing reliance on manual processes, AaaS cuts down expenses and drives efficiency. We tailor our solution to fit your business needs, ensuring that it works perfectly with your existing financial systems and processes.

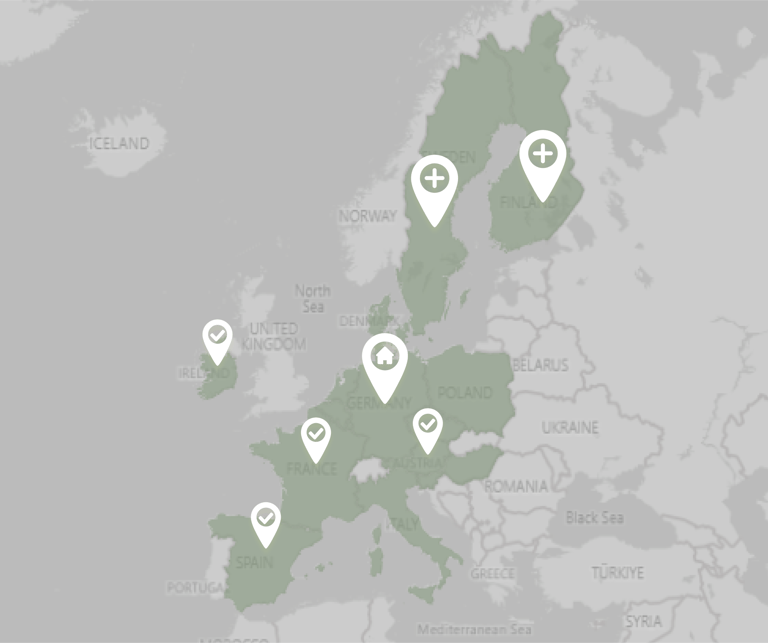

Up to 3x faster time-to-market for country expansions

Our flexible solution is designed to support new markets, currencies, and payment methods. Even large revenue jumps can be easily handled through the highest level of automation. Enjoy trusted quality, proven by external auditors year-by-year - backed up by Bertelsmann.

Explore all features

Optimise your accounting processes quickly & easily.

Download the product sheet now and find out more.

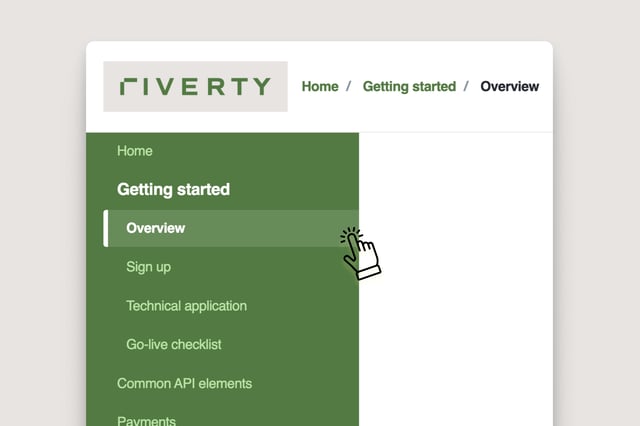

Fast set-up, hassle-free onboarding.

Discover our use cases

Trusted by the best.

Frequently asked questions

AaaS, or Accounting as a Service, is a comprehensive accounting service designed to automate and streamline all major accounting functions, from reconciliation to accounts receivable management. AaaS automates data entry, reconciles transactions, and manages financial records with high accuracy and minimal human intervention, significantly reducing the time and effort required for manual accounting tasks. It includes not only the software but also an experienced team of accountants taking care of monitoring and exception handling.

AaaS is built with flexibility in mind, offering robust API integration capabilities that allow it to seamlessly connect with a wide range of existing financial systems, including ERP software, banking platforms, and payment service providers. This integration ensures that AaaS works harmoniously within your current infrastructure, enhancing data consistency and reducing implementation efforts.

Yes, AaaS is equipped to handle transactions across multiple currencies and regions. It supports international business operations by adhering to local compliance requirements and handling currency conversions, which ensures accurate and legal financial management for businesses operating internationally. AaaS simplifies the complexities associated with multi-regional transactions, making it an ideal solution for companies looking to expand internationally.

We offer different subscription tiers to suit various business sizes and needs, ensuring that companies only pay for the functionalities they require. Our fee structure consists of a small one-time setup fee, transaction fee and one for manual exception handling. Contact us and get a quote!

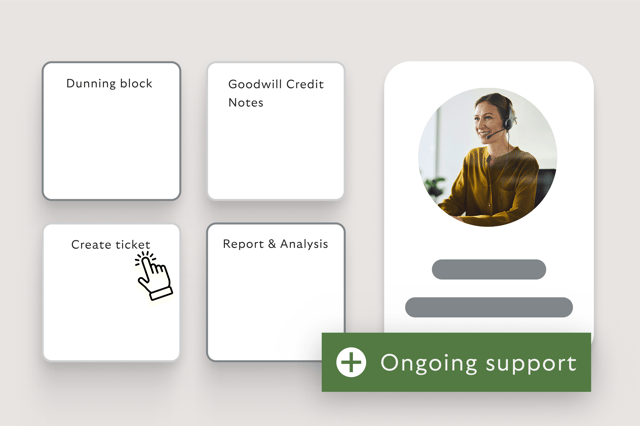

Our clients and their customer service teams are given self-service access to our Riverty portal, which provides live insights into all financial transactions. We provide detailed reports and dashboards for maximum transparency. If a direct exchange with our Riverty team of experts is desired, a ticket can be created via the portal and our accounting specialists provide personal case-by-case support. From a certain company size and a minimum annual turnover, we also provide a dedicated Key Account Team.

Join the leading companies that have transformed their accounting with Riverty.

Meet our team, see our product in action and discover why so many companies choose Riverty.