Insights

Read about Riverty's journey and how we aim to be the most human centric fintech.

AI in Finance: How Responsible Automation Strengthens Efficiency Without Losing the Human Touch

The future of finance will not be determined solely by the existence of AI and new technological innovations, but by the way companies shape and use them. AI in finance opens up new opportunities to identify risks early on, make communication more accessible, and avoid financial burdens. But the focus remains on people—with their needs, situations, and the need to be supported respectfully. Riverty shows how responsible automation enables preventive, fair, and more stable financial practices.

Human-Centric Finance: Why a Sustainable Financial Ecosystem Leads to Better B2B Outcomes

A sustainable financial ecosystem in B2B emerges when social principles are integrated into corporate processes and long-term strategy. Riverty has long worked to balance economic goals with socially responsible financial practices. Human-centric finance and ethical debt collection demonstrate that fairness, transparency, and early support are not in conflict with strong results, as they form the foundation for them.

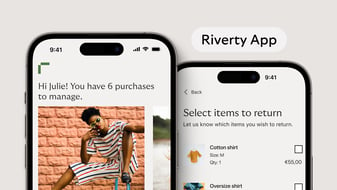

Flexible Payment Solutions: How Leading Online Retailers Strengthen

Conversion, Trust, and Loyalty

Flexible payment solutions rank among today’s most critical success factors in e-commerce. Online shoppers expect to control when and how they pay – immediately, later, or in installments. Merchants enabling this choice build trust and cultivate customer loyalty. From fashion to mobility, numerous brands partner with Riverty to modernize their payment processes.

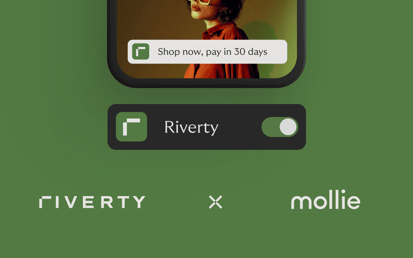

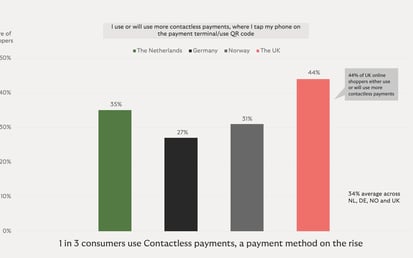

Checkout Payment Methods 2025: From Purchase Completion to Customer

Loyalty with BNPL

Technological advances, changing customer expectations, and intensifying competition have dramatically transformed the online shopping checkout experience in recent years. In 2025, checkout isn’t the end – it’s the beginning of the customer relationship. Merchants offering variety while surrendering their brand identity to platforms during payment lose more than revenue: they lose customers for life.